Investment Company Institute

The Investment Company Institute provides information about the American industry as a whole, and is a useful reference when you want the big picture on mutual funds & ETFs.

By: Robert F. Abbott, a freelance writer and author of Big Macs & Our Pensions

In the United States, companies in the funds industry belong to an organization called the Investment Company Institute (ICI). Other countries will have similar organizations; you can find them by using an online search engine.

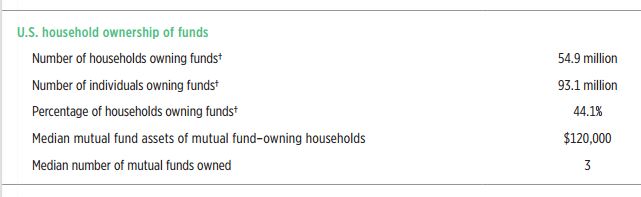

Personally, I find it interesting to scan through the Investment Company Institute’s annual Fact Book. Looking on the first page of the 2016 edition, I see the following information about the people who have bought mutual funds and ETFs (as well as a couple of other types of funds which we’ll name later):

We can quickly see that some 93-million individual Americans (roughly 29% of the population) own at least one mutual fund or ETF. We also see that they belong to 55-million households; that’s about 44% of all households. We also see that each household owns an average of 3 different funds, and that the average value of their holdings is about $120,000.

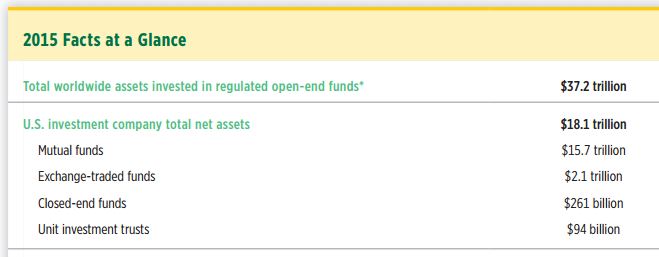

Also on that page, we can get an overview of what types of funds they own:

From this, we see that while ETFs have gained some market share, and get quite a bit of media attention, mutual funds still get most of the investment dollars. Note as well that Americans own about half of the world’s $37.1 trillion dollars worth of funds (open-ended funds refers to mutual funds, ETFs, and institutional investments such as pension plans).

Earlier, I noted that the Investment Company Institute also represents a couple of other types of funds. They’re listed in this table: Closed-end funds and Unit investment trusts. While they manage a lot of money, they’re relatively small when compared with mutual funds and ETFs.

That’s a quick introduction to the Investment Company Institute, and what it does. If you want information about American holdings of mutual funds and ETFs, this could be one of the first places to which you turn.

Other free articles onsite include: High Dividend Mutual Funds