Best High Yield Bond Funds

Summary: Using a mutual fund screener, we identify 10 of the best high yield bond funds, and learn how to use a screener to find funds that fit our unique needs.

By: Robert F. Abbott, freelance writer and author of Big Macs & Our Pensions

Best High Yield Bond Funds defined

Somewhere between those two extremes we find high yield bond funds, which take on more risk than a conventional bond fund, with the goal of bringing in a better return. That extra risk may come from government bonds with longer durations, or by incorporating corporate bonds binto baskets of only government bonds.

Best is a relative term; since we have different goals, different timelines, and different tolerances for risk, what’s best for you may not be right for me. So when we refer to best in this article, it refers to my choices and criteria, and specific date; you can adjust them easily to suit your needs.

In this article, we use a mutual fund screener to identify some funds for consideration, but more importantly, learn how to use a screener to find our own. Note that the funds that come up in this exercise are for illustration purposes only, they are not recommendations. And, remember every investor has to create his or her own best of list.

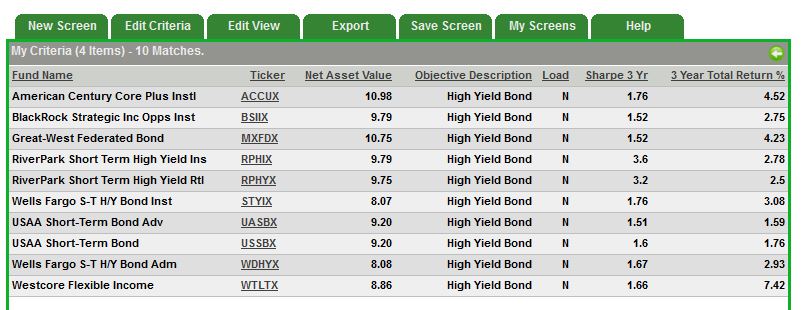

Let’s start with the end result, a list of some of the best high yield funds; after that, we’ll review how we developed this list with the Zacks mutual fund screener.

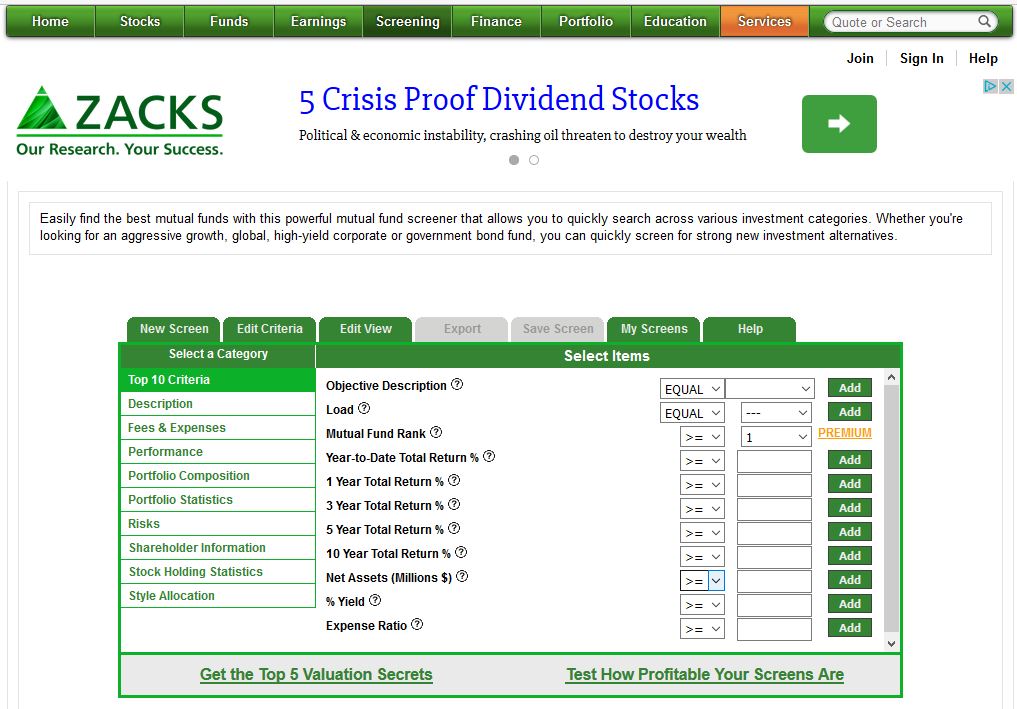

We start by going to the Zacks.com website, and from the menu at the top of the page click on Funds and Mutual Fund Screener. Note that basic screener is free and does not require registration; however, a paid version offers more features. Now, we see this blank screener:

On the line that says Objective Description, we click the small down sign in the blank cell, and from the drop-down menu select High Yield Bond. Having done that, we click on the green Add button (we do not change the Equal field).

Second, we go across the Load line, select N from the drop-down menu, and click the Add button. This directs the screener to look only for no-load funds, and ignore front-load and back-load funds (these are usually sales charges, which we want to avoid).

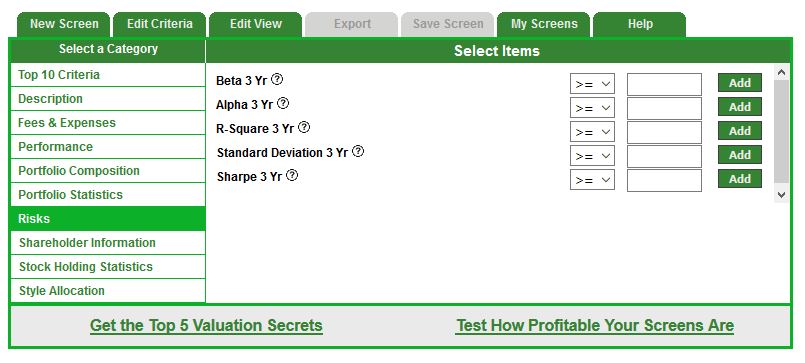

That’s all we need to do on this page, so now we move to the menu on the left side of the screener, and click on Risks. This allows us to add criteria for safety.

We will use the Sharpe Ratio (measured over 3 years) to help manage our risks; the Sharpe Ratio measures the relative amount of volatility (less volatility usually means less risk). Note that the readings are relative, meaning they only have meaning when we compare the ratio of one fund with another. More information is available here.

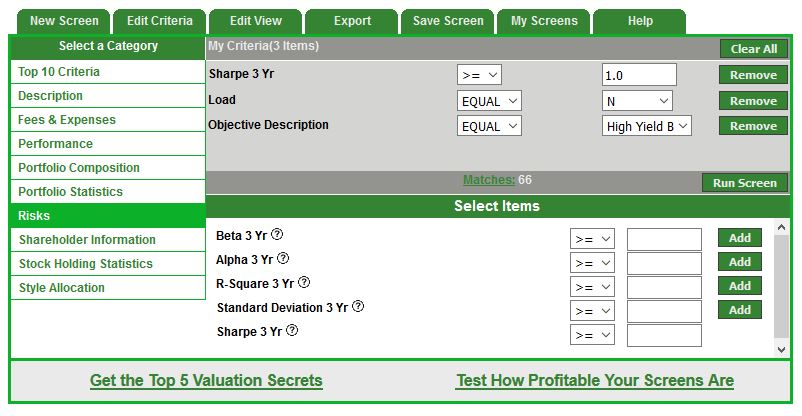

Just to get started, we’ll enter 1.0 on the Sharpe 3 Yr line and click Add; 1.0 is a middling sort of point. We now see the following screen, and next to the word Matches (roughly in the center of the screen) we see the number 66, which means 66 funds meet the criteria we’ve set so far.

We can carve the list down further by changing any of the criteria we’ve used so far, or with criteria we have not used yet. I’ll simply increase the Sharpe Ratio increment by increment until we get between 8 and 12 matches.

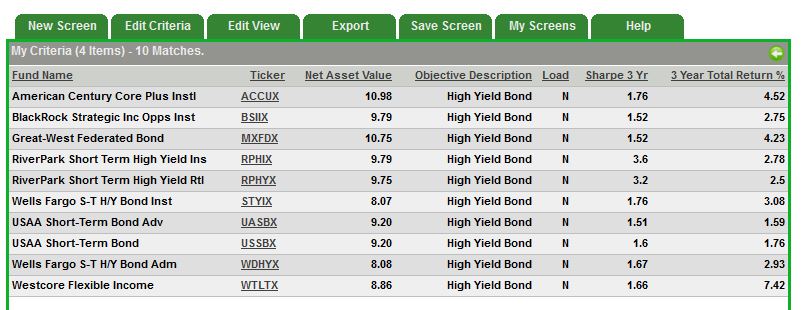

In the appropriate cell on the Sharpe 3 Yr line, I change the number from 1.0 to 1.1 and press the Apply button; I keep doing this until we get to 1.5, which produces an exact 10 matches. This fits with what size of list I’m looking for, so I click the Run Screen button, which produces a list of the best high yield bond funds (using these criteria):

Something important is missing here, the funds’ performance, so I click the Edit Criteria button at the top of the screener, which brings up the original (Top 10 Criteria) page. Once there, I select the 3 Year Total Return % line and put in 1.0 and click Add. This will not do any meaningful screening, but allows me to see the returns on the final screen page:

Now we have a short list of what we can call the best high yield mutual funds (based on our criteria). On looking at the list I see that four of the fund names show Inst or Ins; this means they’re only available to institutional investors such as pension funds, mutual funds, and other big players. So ignore them, and if that makes your list too short, simply tweak the Sharpe Ratio down a bit to get a new and bigger list.

Conclusion: Best High Yield Bond Funds

In just a few minutes and few mouse clicks, we’ve created a list of the 10 best high yield bond funds (based on our criteria). More importantly, you’ve learned how to use a mutual fund screener. To get more comfortable and skillful, just play around with it, seeing how changes in the criteria generate different results. Also, click on the Help button at the top of the screen to learn more. You can’t accidentally buy anything, so feel free to experiment freely with it.

For more on mutual fund screening and screens, read this free article: Mutual Fund Screener