Mutual Fund Screener

A mutual fund screener can sort through literally thousands of mutual funds in just moments, and give you a short list of good candidates. This article explains how to use one such screener.

By: Robert F. Abbott, freelance writer and author

In a previous article, I used the mutual fund screener at Zacks (an online investment portal) to create a list of 10 top healthcare mutual funds (actually, it turned out to be 12 funds).

In a previous article, I used the mutual fund screener at Zacks (an online investment portal) to create a list of 10 top healthcare mutual funds (actually, it turned out to be 12 funds).

This article explains why I chose this screener, and how I found a dozen top healthcare funds in a universe of more than 19,000 mutual funds.

Why Zack’s Mutual Fund Screener

I chose to use Zacks’ screener because of the number of different functions it provides. For example, I wanted to be able to screen by the Sharpe Ratio, which provides a way of comparing the risk/reward relationships between funds. The other screeners I found did not provide this function.

How to Use this Mutual Fund Screener

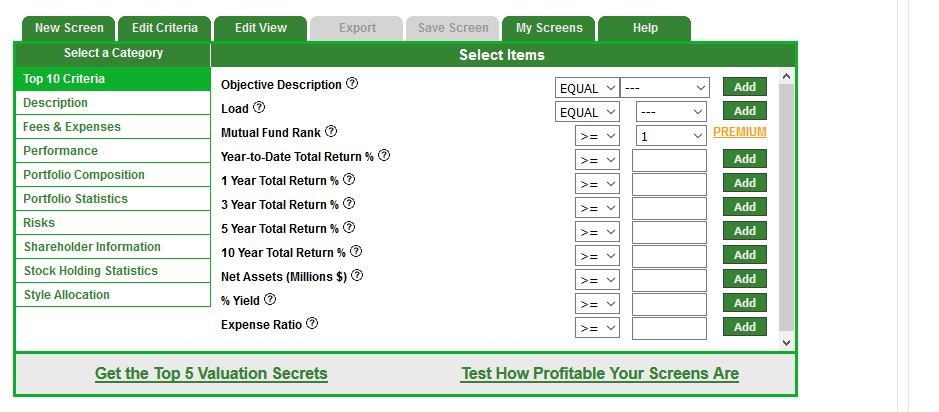

At the Zacks’ home page, I clicked on Funds and then on Mutual Fund Screener. That took me to this page: https://www.zacks.com/screening/mutual-fund-screener

I filled out only one cell on that page. Going across the first row, Objective Description, I clicked on the blank cell and from the drop-down menu selected Sector – Health, leaving the cell next to it at EQUAL. This selection means the screener should only look for health or biotechology funds (often health and biotech are combined).

In addition, I left the Mutual Fund Rank at 1, which means the screener only looks for funds with a rating of 1. Zacks scores funds from 1 to 5, with 1 being a strong buy, and 5 being a strong sell, but unless you sign up for Premium Access, this will be your only selection here (that’s okay for me).

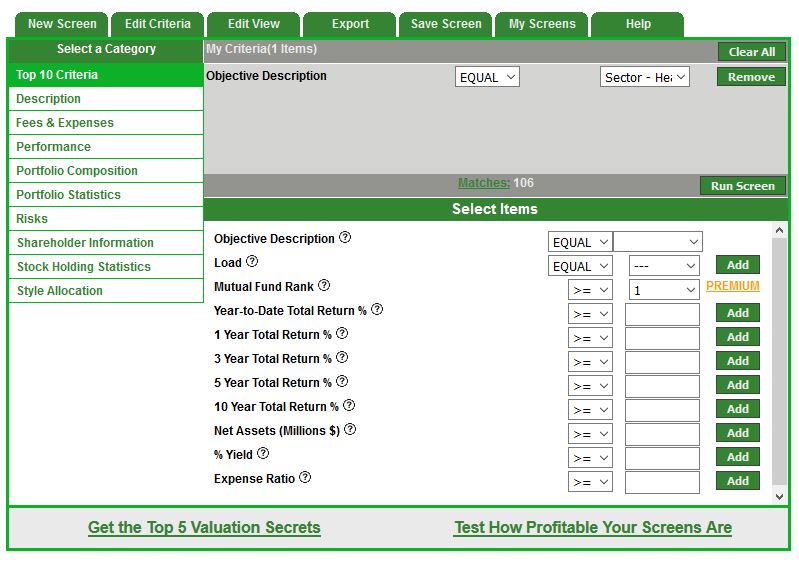

After clicking on the Add button next to Sector – Health, the screener did its first screening, which took just moments.

Out of the roughly 19,000 mutual funds available, the screener selected just 106 (you can see that number listed as Matches at the bottom of the gray area). This means our list has been whittled down to just 106 funds that are both in the health sector and rated as 1 (strong buy).

I also want the funds to be safe, as in less likely to experience a loss. That’s where the Sharpe Ratio comes in (click here to learn how to make safer choices with the Sharpe Ratio).

From the menu on the left side of the screener I clicked on Risks and in the Sharpe Ratio row entered a value of 1 and clicked the Add button. That reduced the number of prospects to 66, a reduction from the first screen, but still too many.

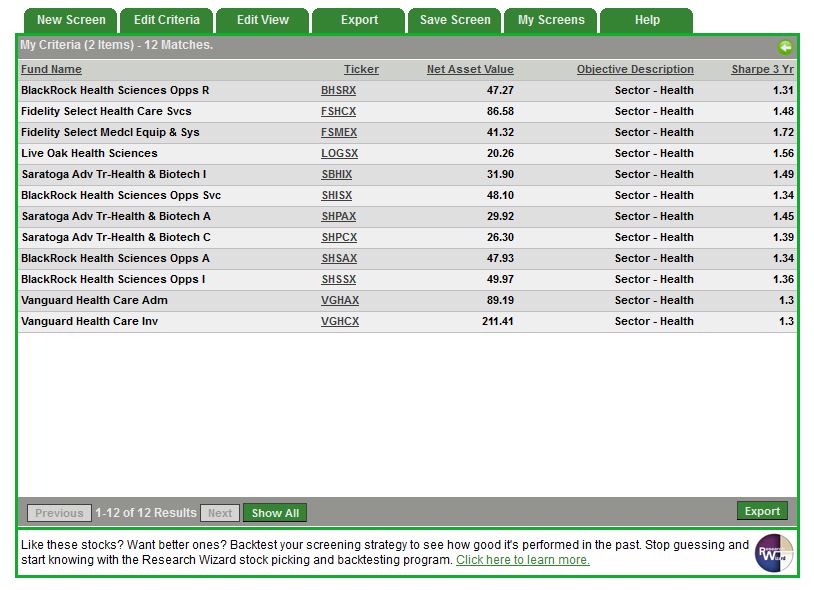

Next, on the Sharpe Ratio line (the one at the top of the screener this time), I changed the value to 2, and clicked Apply. Now the screener came back with 0 results, meaning my parameters had become too tight. After experimenting a bit, I found a value of 1.3 produced 12 results, which is close to what I’m looking for (10).

Note that this list has been generated for educational purposes; it is NOT provided as investment advice.

So, in just a few minutes and a few clicks, I was able to reduce the universe of 19,000 mutual funds down to a dozen. Note, though, the first time I used the screener I spent perhaps 20 minutes or a half hour figuring out how it worked, and what I could and should tweak.

If this was your mutual fund screen, you would now have a manageable short list, and could begin your due diligence on each of them. After looking closely, perhaps you’ll decide none of them are right for you. That’s okay. Simply head to the screener and tweak the criteria until you do find something that matches your unique needs and risk tolerance.

Find the Zacks’ mutual fund screener at: https://www.zacks.com/screening/mutual-fund-screener