Mutual Fund Holdings

What Important Details Can You Find in this Section?

By: Robert F. Abbott, freelance writer and author

By: Robert F. Abbott, freelance writer and author

You may think that having looked at the name, you can skip a mutual fund holdings list, or at least a list of its top holdings. But should you?

Consider this: You have two large cap mutual funds under consideration. One features mostly technology stocks such as Amazon and Facebook in its list of top holdings, while the other features blue chip stocks such as Proctor & Gamble and Home Depot. It’s likely these funds will behave quite differently in the years ahead, depending on conditions which favor one or the other.

So, yes, I would advise at least a quick look at the list of mutual fund holdings, to determine what types of stocks you’re buying through the fund, and to know what you might not be getting (a red flag we’ll discuss later).

This article is part of a series on top mutual funds. In the series, we dissect example funds listed on the U.S. News & World Report’s best mutual funds list. I use the site and the funds below only for illustration or educational purposes, they are not recommendations or endorsements. You must do your own due diligence or consult with a financial adviser.

In this article we use the Fidelity® Large Cap Growth Enhanced Index Fund (fund symbol FLGEX), ranked fourth on the Large Growth list at U.S News & World Report website. We click on the holdings tab, as shown below:

The Mutual Fund Holdings Tab

When you click on the Holdings tab on the left side of the page you should see something like this (not exactly, of course, because the details likely changed since this article was written in April 2016):

At the top of the middle column you see Fund Holdings, followed by a brief description of the types of securities held by the fund.

This description should closely align with the name of the fund. If it does not, move along right away to different prospects. A discrepancy would suggest the fund’s managers failed to deliver on their original mandate and now have shifted their sights to different securities. It may also mean the fund has a very short history with these securities. As I say, best to look elsewhere, and not waste any research time on a changed fund.

In the case of FLGEX we get no description (at least not at the time this article was written), so we need to sort through the issues differently as we proceed.

Looking just below that we find Asset Allocation and a pie graph. From the graph we learn that almost 99% of the fund’s investments are in Equities, another word for stocks. That’s consistent with the fund name.

Cash makes up the rest of the holdings. We should expect at least some cash in every fund’s holdings, so it can pay out unit holders who decide to sell some or all of their units. In addition, some funds hold larger amounts of cash so they can buy bargains, or at least perceived bargains when they surface.

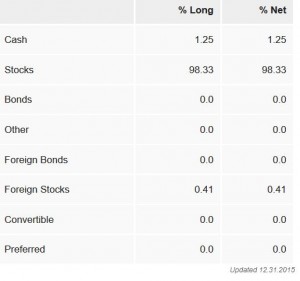

Moving down the page a bit more, we find a table that presents some of the data shown in the graph.

In this case we get some additional information, including the fact the fund holds a small amount of non-U.S. stocks, less than half of one percent, making this very much a domestic equities fund.

Moving down, you will note the word Long at the top of one of the columns in this table. Long refers to owning a stock or buying a stock. On the other hand, being short a stock means the fund has borrowed shares of a stock from a brokerage. A fund manager might short a stock when he or she expects its price to drop quite a bit below the current price. Go to this article for more information on shorting a stock. Shorting offers a lucrative but risky way of playing the stock market; this fund does not short stocks , and that’s a good thing overall.

% refers to the proportion of that type of security. Again we see the fund almost exclusively holds equities, domestic American equities (stocks).

The Top 10 Holdings

Continuing on down the page, we come to a list of the FLGEX’s top 10 holdings:

A quick scan shows us five of the top ten spots go to technology companies, and not just any technology companies. Apple, Amazon, Microsoft, Alphabet (the corporate entity behind Google), and Facebook all represent technologies that changed the world, and grew exponentially over the past decade or so.

They’ve allowed the fund to fulfill the growth aspect of the fund’s name. The question for a would-be fund buyer then becomes, “Do I expect these companies to keep on growing as they have in the past?”

Note, too, the inclusion of Gilead Sciences and Amgen, two biotech companies with sterling growth records? What do you expect them to do in the future?

And, two consumer-oriented stocks, Home Depot and PepsiCo. What do we expect of them in the future?

So, the fund has a strong stable of companies that grew exceptionally well by meeting the needs of consumers and other businesses. But, we also know now that this fund depends heavily on those companies continuing their winning streaks.

Mutual Fund Holdings Conclusion

It doesn’t take long to check a mutual fund’s holdings, and that extra minute or two should give you confidence that you will get what the fund advertised.

If you notice significant discrepancies, cross the fund off your list and move on go the next one.

Finally, ask yourself what the future holds for the top holdings in the fund; it can only be as strong as the stocks (or other securities) in it.